Are Rates That Restrictive, or Is This the Part of the Equation I Just Don’t Get?

What If Growth and Credit Are Just a Constant Feedback Loop?

It seems like the whole world is lining up for the same two trades right now: short dollar, short yields. But seriously, when does the market ever make things that easy? First of all, Trump’s been in office for three days—three! And second, it’s just not true that the moves we’ve seen in yields and the dollar are all about him. Sure, he’d probably love to take the credit, but let’s not kid ourselves—it’s far more nuanced than that.

Since September, we’ve seen a nearly 125-basis-point increase in the 10-year yield and a 10% rally in the dollar, from 100 to 110. Expectations for SR3 Dec 2025 have climbed from 2.745% to 4%. Meanwhile, we’ve seen a complete Fed pivot—from cutting 50 bps in September to taking a more cautious, patient approach. Add to that the Sahm Rule (recession warning) being ruled out, unemployment swinging even lower, and inflation exceeding expectations. So maybe it’s time to take a breather from politics and focus on two key metrics: growth and inflation.

The Growth Story

Strong consumer spending

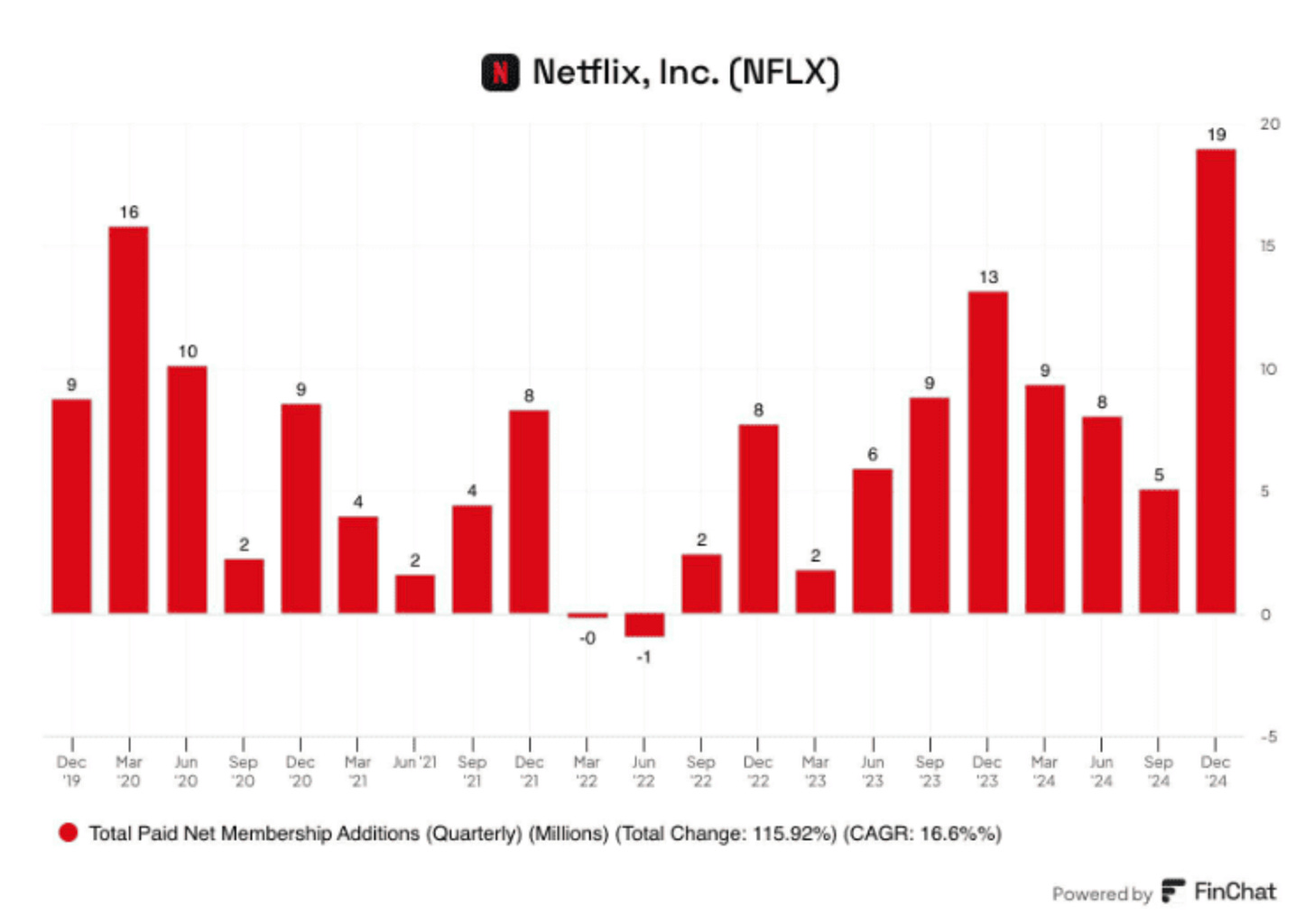

U.S. households aren’t just resilient—they’re thriving. Netflix’s latest earnings are proof of that, with four times the new subscribers in a single quarter. That’s insane. Even real estate, one of the first sectors typically hit by higher rates, is bouncing back. Consumer spending has been so robust that the labor market remains exceptionally strong. Nonfarm payrolls above 200K? Historically high.

Chart 1.a: The Resilience of U.S. Households

ISM manufacturing: inching toward 50.0

While services—80% of the U.S. economy—are booming, manufacturing, often the weaker sibling, is signaling a potential comeback. Call it the Trump effect or whatever you want, but with a steeper yield curve and stronger new orders, ISM manufacturing seems poised to rise above 50, signaling expansion. If services stay resilient and manufacturing picks up, here’s what happens: demand for goods increases → factories hire more workers → workers earn more → spending rises → growth accelerates → credit markets open up → money flows through the economy → and growth keeps performing exceptionally well.

Credit spreads and the steepening yield curve

Money supply has been doing the heavy lifting while the Fed lets its balance sheet shrink. But liquidity isn’t solely controlled by the Fed—banks are stepping in. With credit conditions ample, banks are lending more because profit margins improve as the yield curve steepens. Loans flow into the real economy (boosting GDP) and financial markets (lifting equities and crypto). While this can’t last forever, we’re still far from bubble territory—closer, but not there yet

Chart 2.a: Money Supply is Driving Liquidity Growth, regardless of QT

Chart 2.b: Banks Appear to Be Holding Strong

Chart 2.c: Steeper Curve Boosts Profit Margins for Banks

The Role of Politics

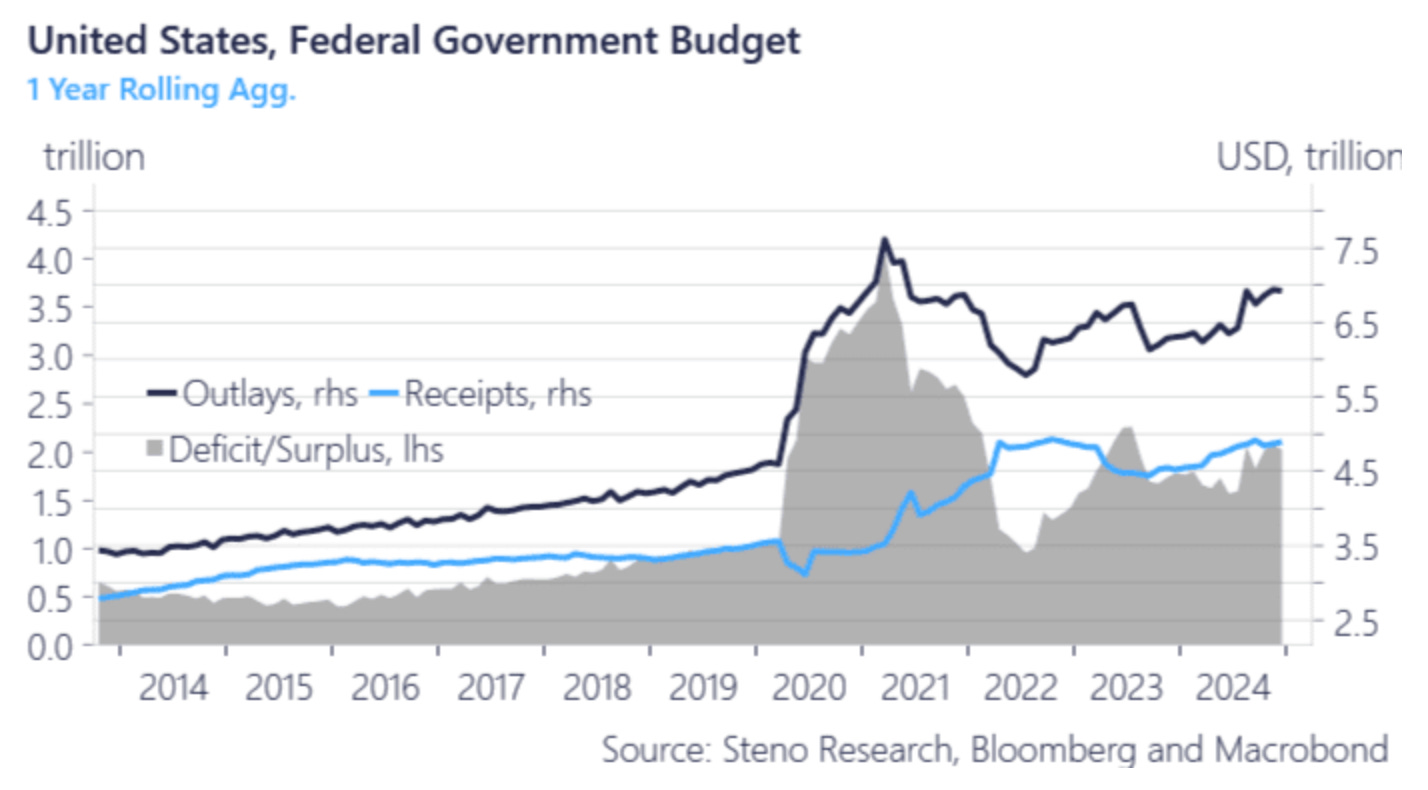

The White House just announced massive plans for semiconductors and AI plants, both of which are dollar-intensive. The question is, how will these projects be funded? Tax cuts? Tariffs? Neither seems sufficient. More likely, deficits will balloon again. Deficits are an irresistible short-term fix for politicians, and Trump isn’t likely to resist that temptation.

Trump’s approach is strategic, bringing in figures like Musk and deficit hawk Scott Bessant to sell the idea that this time, things are different. The goal? Convince Congress to speed up debt ceiling approvals or amend related rules. But skepticism abounds. Vivek got fired on day one, and Musk is already clashing with the administration on deficit reduction claims. It’s hard not to call B.S., but the administration’s short-term strategy might be enough to sway Congress for now.

Chart 3.a: No Way, Jose—Deficit Isn’t Going Down

Inflation: The Big Question

Okay, so what about inflation? The Fed keeps saying it’s focused on keeping it in check, but the market seems to call bluff. Powell’s pivot from cutting rates to this “wait and see” stance doesn’t exactly scream hikes are coming. We saw equities take a justified hit post-FOMC (we were in that trade too), but they couldn’t sell off further. And if you zoom in on the yield curve—whether a week or a month ago—it’s flattening, signaling we’re likely to stay at these levels for longer.

And that’s the kicker: high-beta assets like crypto and equities just haven’t been able to go down hard. The market is saying loud and clear that monetary policy isn’t as restrictive as it might need to be.

Unto Trading…

This is a pivotal moment to own risky assets, as the Federal Reserve might finally be moving in the right direction. However, their approach remains backward-looking, particularly when evaluating where rates are genuinely restrictive.

Looking at bonds and their trading patterns today, we’ve seen interesting dynamics over the past few days. On Monday and Tuesday, the “Trump trade” began to unwind, and the curve bull-flattened, with the long end seemingly celebrating the possibility of no tariffs—a deflationary signal. However, today’s bear steepening felt more logical, albeit still lagging. The underlying reality is that fiscal spending necessitates the issuance of more Treasuries. This increase in supply should, globally, push yields higher. While the choice of tenure by Scott Bessant in the Treasury may influence auction dynamics, the broader picture remains unchanged: the shorter the maturity issued, the more stimulated the Treasury auction becomes. This acts as a quasi-Yield Curve Control (YCC) mechanism, containing yields. The takeaway is clear: bonds should be sold on rallies, and the curve is expected to bear steepen, reflecting the risk that monetary policy may not yet be tight enough to contain growth and inflation pressures.

On the Dollar

There’s a case to be made that fiscal spending could spark a dollar selloff, much like what we’ve observed with the British Pound, where gilt yields have surged while the Pound weakened. However, the U.S. Dollar is in a different league—it’s the “big brother” in the global financial system. Its demand is so critical that the same argument doesn’t fully apply, at least not within this cycle. I would argue for consolidation at current levels or a gradual drift upward, in line with yields.

The Caveat

The key is to ride this wave upward until the Federal Reserve’s reaction function shifts. Ideally, Powell would adopt a dovish tone, which would postpone the risk of a policy mistake and give risk assets room to rally further.

Currently, I’m selling ZN (10-year Treasury futures), anticipating a more significant rally to sell into. We haven’t yet reached a point of “seller’s remorse” within this massive channel, which could present the optimal entry point. My portfolio is already heavily weighted toward risk, so I won’t allocate additional capital there. But will look to potentially add long Nasdaq on dips.

Chart 4.a: Could It Be Time to Load Up on Short ZN?

Until Next Time…

Sam

Please note that the content provided above is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.