A Primer: Why Most Traders Fail and How to Avoid It

Find your edge, build a process around it, rinse and repeat.

It’s funny—I recently had a great conversation with someone eager to break into trading. Same age, same educational background, and though our trading experiences differ, I recognized that familiar look in his eyes—an insatiable curiosity, a deep pull toward the forces that drive markets.

Markets are arguably one of the most fascinating human inventions. They not only reflect our own nature—greed, fear, ambition—but also intertwine with the social, political, and economic foundations of the world. A relentless, ever-evolving beast that humans obsess over yet struggle endlessly to tame.

Stumbling Into Trading (2019): The First Lesson

I stumbled into trading by pure luck back in 2019, when I just had turned 18. Some friends convinced me to attend a conference where a group of older guys were making a lot of noise about trading "FX"—how easy it was to make money—flashing charts overloaded with technical indicators, more for intimidation than explanation.

I couldn’t make sense of a single thing, and honestly, I wasn’t convinced they could either. But strangely, it didn’t matter whether they were actually making money or not. Walking home that afternoon, all I could think was: Why them and not me?

I had always been sharp, curious, and determined—so what was stopping me from figuring it out myself? At the very least, I’d give it a shot. But where does one even start?

Well, in my case, not smoothly.

The First Trade

I opened a live account and funded it with $1,000.

I blindly copied a trade recommendation—shorting USD/MXN.

I had absolutely no clue what USD/MXN was.

I didn’t understand shorting, had no idea what asset class I was trading, what instrument I was using, or what leverage I had on.

For the curious, I was trading CFDs—highly speculative, with absurd bid/ask spreads—and had unknowingly used 20x leverage.

I’m guessing you can figure out what happened next. The trade went south, I got a margin call, and within 24 hours of my so-called "trading career," I had blown my entire account.

Losing hurts. But it hurts less if you learn something from it.

And my biggest lesson? Taking someone else’s trade was a mistake. A pathetic one. It was as if someone had told the goalkeeper to let the ball in just to make me feel better. It didn’t matter whether the call was right or wrong—what mattered was that I wasn’t the one calling the shot. Someone else did. It was their trade, their idea, their reasoning, their conviction (good or bad)... and that made me feel truly embarrassed and weak.

The money lost wasn’t the painful part. It was why I had lost it.

That day, I made a decision: I would never, ever trade someone else’s trade again.

If I was going to win or lose, it would be on my own terms—through my analysis, my edge. At the very least, I wanted to be able to say that my results, for better or worse, came from my own ability to think.

Chart 1.a: A fun anecdote from the early days of my trading journey.

Learning How to Think (2019-2020): Building a Foundation

For the next year, I devoured every trading concept I could find. I spent weeks at a time studying one topic in depth—whether technical analysis, macroeconomics, or market structure.

I’d learn something, backtest it through charts, demo trade it, keep or discard:

The more I discovered, the more I felt like I was progressing. Each new tool I learned went straight into my back pocket. Notebooks filled with notes, brain fried after hours of staring at charts.

And then, I hit a wall—I needed a new challenge.

After reading Market Wizards, I noticed a common theme: nearly every successful trader had a mentor—someone who had helped translate raw knowledge into real-world application.

I needed to become an apprentice.

Mentorship & Real-World Trading (COVID Era, 2020-Present)

So, at the start of COVID, I landed a spot on a small prop desk, where I met two traders who would become my mentors They were born in the era of day-trading futures, profiting from economic data releases, central bank meetings, and newswires. Their approach was entirely different from what I had been learning—I was back at square one, eager to absorb everything.

Fast forward to today, one opportunity led to another, and I’ve had the privilege of learning under some of the best traders in Singapore, London, and Copenhagen.

The journey has been anything but linear, but that’s what makes it exciting. And the best part? I’m still just getting started.

But if there was one lesson I learned from my mentors—something that separated them from the traders who burned out and disappeared—it was this:

Execution alone isn’t enough. You have to analyze, refine, and evolve.

The Reality of Trading: Why Most Traders Fail

After years of learning, refining my process, and working alongside professionals, one thing became clear—most traders don’t make it.

Chart 2.a: Brent Donnelly Trading Process

Many traders spend their time planning and executing trades but fail to analyze and refine their trading process. Journaling is one of the most powerful self-reinforcement tools, allowing traders to sharpen their skills in real time.

I was first introduced to this concept by a good friend,

who showed me how to document my trades. Think of it like Carlo Ancelotti reviewing Madrid’s performance against Atlético—there’s no way he wouldn’t go back to analyze what worked and what didn’t.Maybe the formation was wrong (the trading idea was solid, but the entry was too early). Maybe a player needs to be benched (you should stop trading Nasdaq because bonds are offering a better setup). Or maybe the team struggled because they were playing away (emotions took over, impairing your ability to execute).

The reality is, generating alpha is extremely difficult—roughly 90% of retail traders lose money, and only around 5% stay profitable over the long run. To tilt the odds in your favor, you need to leverage every possible edge. Journaling is one of them.

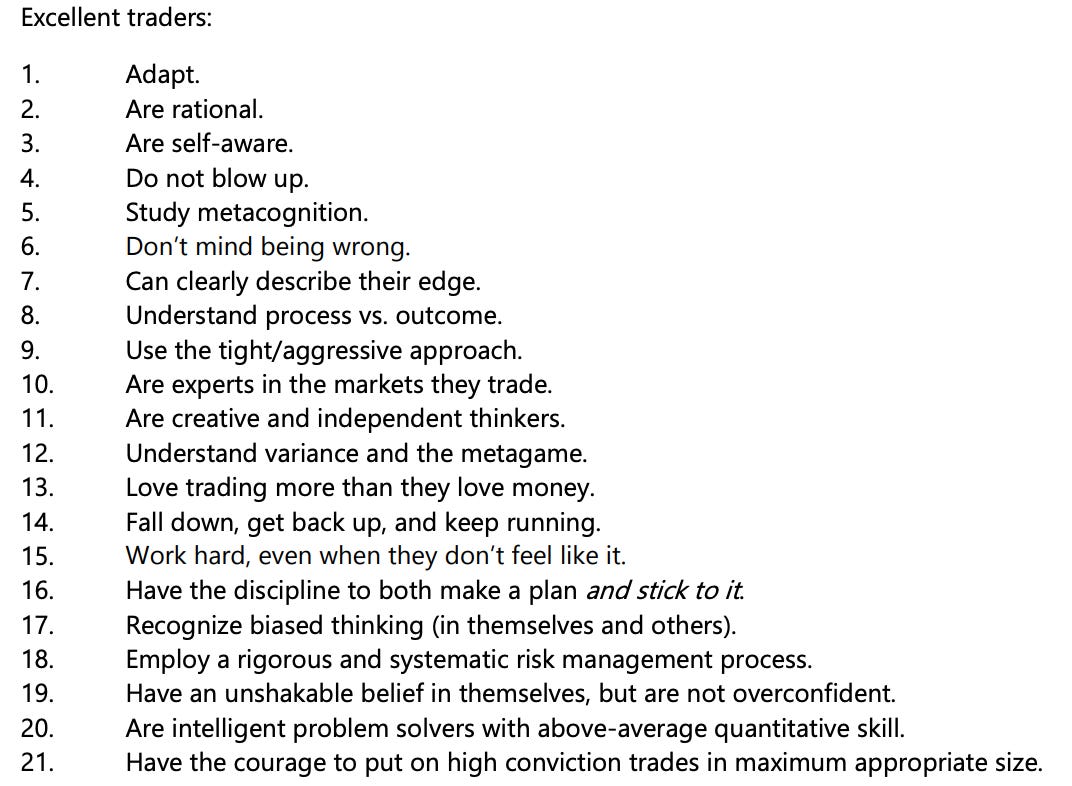

Brent Donnelly, author of Alpha Trader, outlines the key differences between excellent traders and losing traders. The most striking takeaway? it’s far easier to lose money than to make money.

Examining the two lists, losing traders exhibit 13 common traits, while excellent traders possess 21 essential skills—nearly twice as many. This highlights a critical truth: trading successfully requires far more discipline, adaptability, and skill than simply losing money.

Chart 2.b: What Differentiate the Best from the Worse

A few key insights emerge:

Losing is effortless – Many traders fail due to overconfidence, lack of an edge, impulsivity, or an inability to adapt. The barriers to failure are low, and many fall into these traps quickly.

Excellence demands a broad skill set – The best traders must master not only market knowledge but also self-awareness, metacognition, and psychological resilience. They recognize bias, embrace uncertainty, and maintain a systematic approach.

Resilience and adaptation separate winners from losers – Losing traders are rigid in their approach, while excellent traders learn, evolve, and persist even after setbacks.

Ultimately, trading is a game of probabilities. Since the odds are naturally stacked against traders, developing and reinforcing the right habits is essential to staying in the game.

Brigding the Gap: Incorporating Journaling

So, let’s do just that—let’s bridge the gap between where most traders fail and how I ensured continuous improvement. I turned to one of the most underrated yet powerful tools in trading—journaling.

There are many available journaling tools, but I’ve been using Edgewonk consistently for the past three years. For the sake of this exercise, I’ve pulled up one of my old trading accounts.

Disclaimer: My trading approach has completely evolved since this period. At that time, I was focused on day trading. I’ve discussed this before, but to keep it brief—I realized that stepping back to focus on the bigger picture and allowing trade setups to fully materialize was a more sustainable edge for me compared to the “wild west” days of short-term trading.

Chart 2.c: Analyse your PNL!

First and foremost, journaling provides a clear way to analyze your PNL. You can break down key statistics such as profit factor, win rate, risk-reward ratios, and more.

Beyond that, every trade you take can be filtered and categorized, allowing you to observe behavioral patterns that might not be obvious in the moment.

For instance, I might discover that:

I had a consistent edge trading Nasdaq and gold.

I made most of my money before the bell (9:30 AM) but tended to give it back in the afternoon.

January was a terrible month, so maybe I should allocate less size there and focus more when May or October rolls around.

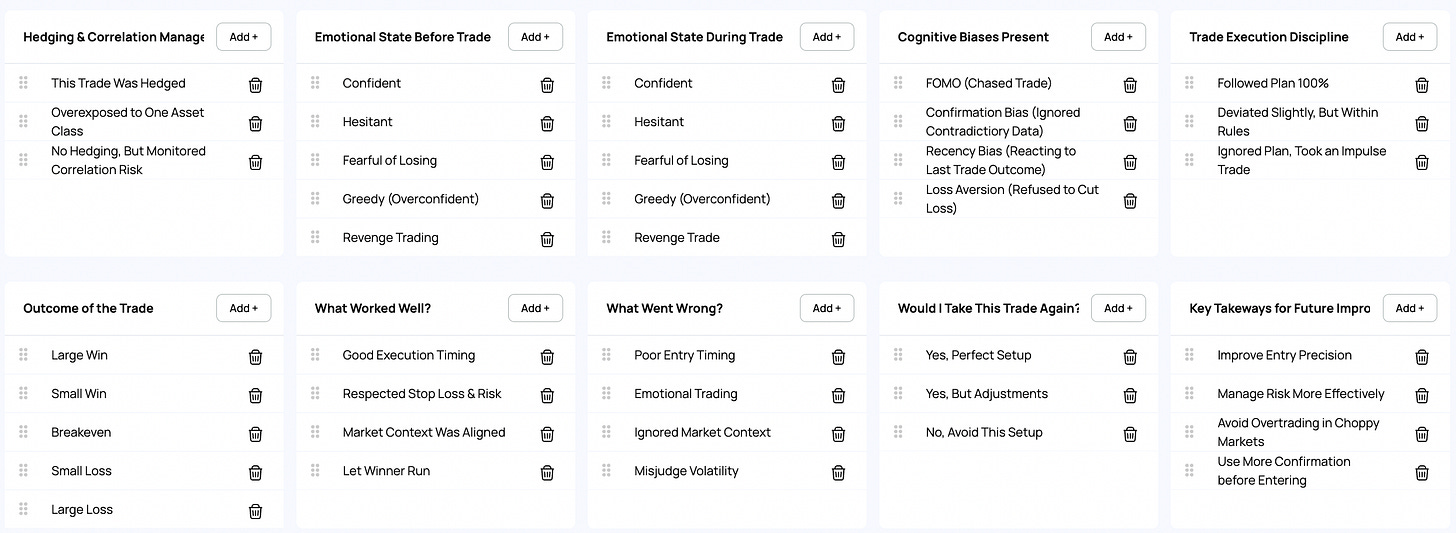

To make this process effective, I’ve developed an approved list of key subcomponents regarding my trading approach. This is based on psychology books I’ve read, past behavioral patterns, and observed mistakes.

This isn’t meant to be a simple reflection exercise—I take a methodical approach, ensuring that I can pinpoint weaknesses and refine them. By being precise, I’m able to identify and improve upon my edges.

Here is what I look at:

While most of you get the point, let’s elaborate on a few key aspects.

Execution is one of the most overlooked yet crucial aspects of trading. Technical traders tend to be rigid in their execution style, while fundamental traders often overlook execution altogether, focusing solely on their thesis and chasing price to get filled.

For example, say I want to go long Chinese equities and place a passive order, waiting to get filled. But as the market moves higher, my order remains unfilled. What I used to do—and to be transparent, something I still occasionally catch myself doing—is get frustrated, feel the FOMO creeping in, and start chasing the trade by raising my limit price. By the time I enter, the trade has already rallied 50 points. This is a major problem. At that point, I am no longer in control of the trade; I have let the market take control of me. This behavior leads to two critical issues. First, my stop-loss is more likely to get hit because my entry was poor. Second, even if the trade works, my process was flawed. That’s a dangerous cycle because reinforcing bad behavior—even when it results in profit—will eventually catch up with me.

This ties directly into my emotional state before and during the trade. If I were to log this trade in my journal, I would mark my pre-trade mindset as overconfident or revenge trading. During the trade, I might log my emotional state as fearful of losing or hesitant. When reviewing my execution, I might conclude that my stop was too tight because I entered the trade impulsively. This type of reflection is valuable because it connects multiple aspects of my decision-making. It reveals whether my mistakes are isolated incidents or part of a larger behavioral pattern that needs to be corrected.

Understanding these tendencies is crucial because from the moment a trade is executed, I am no longer just a trader—I become a risk manager. The job shifts from trade selection to trade management.

While journaling helps me expose weaknesses, it also allows me to reinforce my strengths. The best traders often make money by doing one thing exceptionally well and repeating it consistently. Instead of trying to master everything, they find their edge, refine it, and execute it over and over again. Journaling allows me to highlight my best setups, recognize what works, and systematically scale into those opportunities.

Another powerful feature of Edgewonk is the ability to add notes and images to each trade. If I notice a major drawdown in my PNL, I can go back and see exactly what I was thinking at the time. I can revisit the trade setup, analyze how I felt before execution, and determine whether there was an emotional component to my decision-making. By reviewing past trades visually, I can identify recurring mistakes and work to eliminate them before they happen again.

Chart 2.d: Annotate and review all of your trades.

Anyways, keep in mind that I am not promoting any platform whatsoever—I’m simply sharing how I use my journal in a plain and transparent way.

Final Thoughts: The Only Way to Lose Is to Quit

So, to wrap up this post—for those who are hesitant, scared, or worried that trading isn’t their sport, I’ll say this:

The only way you can truly lose in this game is by giving up.

There will be times when you hit rock bottom—those moments when everything feels like it’s working against you, when frustration clouds your judgment, when quitting seems like the logical choice. But the only real loss comes if you actually walk away.

Yes, you’ll lose money in the beginning. Yes, you’ll feel like you’re not progressing fast enough. Yes, you’ll make mistakes—more than you’d like to admit.

But the one promise I always made to myself was this: I will never quit.

Give yourself the opportunity to reach rock bottom—not as a failure, but as a turning point. Use it to reflect, adapt, and evolve. Take every setback as a lesson, every mistake as data, and every challenge as a test of resilience.

But don’t let it break you. Because in trading, time in the markets is what gets you closer to timing the markets.

And now, as I continue to refine my edge, I want to take this process a step further.

I’ve decided to start sharing my trading process with Pro Clark Street members. Moving forward, I plan to implement a bi-monthly session where I’ll walk through key observations related to our official Clark Street PNL.

We’re going to deep dive into post-trade analysis, behavioral patterns, and decision-making, breaking down both the strengths and weaknesses of my own trades.

I want this exercise to be fully transparent so you can see exactly the risks I’m taking. Transparency makes me more accountable—and accountability makes me a better trader.

Until next time…

Sam

Please note that the content provided above is for informational purposes only and should not be considered financial advice. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Hey Sam thank you very much for showing your journey and the platform that you use I didn’t know there was a platform for journaling ill use it instead of excel. I have a great risk management system on excel that I’ll keep but the journaling part as quite confusing at times. It is quite nice to see your journey because I am still at the beginning of the graph.

Question for edgewonk do you need to manually enter your orders into the platform?

Or when you enter and exit a trade it is automatically entered in edegwonk and your job is to journal?

Thank you god bless! Enrico

Started my journey last year and every day is still a learning experience and finding ways to improve. The journaling has been a huge positive on my mindset because I find that even if I'm currently not consistently profitable, it allows me to really reflect, identify and refine the process. Many bad habits I am still working to get rid of/control but really enjoying the whole process thus far.